Customer Relationship Management software is a tool that can be used by many different professionals to track a variety of activity and productivity. Since we here at Touch Ahead cater mainly to venture capitalists and the private equity community, we’ve mentioned how these people lead busy lives and can sometimes find it difficult to keep track of all the potential deals they’ve got going on around them. We’ve learned that there are certain factors that one must continually track in order to maintain control over their deal pipeline as part of implementing a successful CRM.1

Matt Keenan names the five “items that I see world class companies embedding into their CRM projects”: Value, Volume, Velocity, Conversion, and Win Rate.1 Basically, he says these are the five basic metrics a company should be basing its pipeline on – whether they are measuring deals or other activity. Here, we will take a look at how these metrics can apply to making and tracking deals.

Value

“Value is the about of potential revenue that is in the pipeline1” – how much potential revenue sits in the deal pipeline for a venture capitalist based on what kind of deals they could be making. When an investor funds a venture, they do it because they see a certain amount of potential in that company. They believe in whatever product or services the venture is selling, and believe that there will be an ROI worthy of the amount of funding they inject.

“Value is the about of potential revenue that is in the pipeline1” – how much potential revenue sits in the deal pipeline for a venture capitalist based on what kind of deals they could be making. When an investor funds a venture, they do it because they see a certain amount of potential in that company. They believe in whatever product or services the venture is selling, and believe that there will be an ROI worthy of the amount of funding they inject.

In order to track the potential value, an investor must know in full detail a venture’s business plan. Some questions that a business plan should answer include: “What is the growth potential of this company or project?” “What are the projected revenue and profit margins?” and “How is the capital going to be used?”2 Knowing the answers to questions like these and monitoring them in a CRM will help a VC determine whether or not a venture is worth pursuing.

Volume

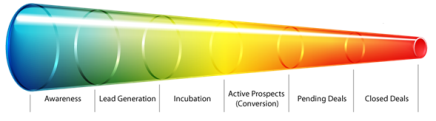

The number of potential deals in the pipeline at any given time is a measure of the volume of the pipeline. Keenan deems knowing this as important because there are only so many deals that can be worked at any given time, and how much work is required of each deal will vary.1 In the article, “Basis for Venture Capital Decisions,” it says that venture capitalists will look at 1,000 to 5,000 business plans per year. This is a large volume of opportunities in the pipeline, and, though VCs will only actually work with a fraction of these ventures, that still means there’s a lot to be looked at and maintained in the pipeline. Further, venture capitalists are not banks. They don’t fund a business, sit back and relax, and never worry about that business again. VCs invest their money and time into ventures, so keeping track of the level of activity associated with every venture is also hugely important.2 “A good CRM system provides insight as to the number of deals in each stage of the pipeline so you can identify bottlenecks and potential risks to deals through the lack of attention.1”

Velocity

The next metric we are using our CRM to track is velocity – “how fast a deal moves from stage to stage in your sales process,” according to Keenan. Monitoring deals is important because it will help you determine how to treat each of your deals, thus eliminating risk.1 For example, if a transaction happens to be moving particularly slow, maybe it’s time to revisit that deal and decide it’s time to squash it altogether – OR focus more attention on it in order to increase its potential. If another deal happens to be moving faster down the pipeline, maybe a VC will decide it doesn’t need as much attention as other opportunities.

Conversion

The “basic element of a sales pipeline…associated with the movement of leads to qualified opportunities” is known as conversion.1 As mentioned earlier, venture capitalists may look at upwards of 5,000 business plans (AKA potential deals) each year. “Out of that approximately two percent will ever get an interview.2” Let me repeat that, an interview. That’s not even a deal necessarily! So based on conversion of leads to qualified opportunities, a VC will interview 20 to 100 ventures per year.2 Keenan says “Conversion matters as a part of your pipeline metrics because it is a great leading indicator about your future pipeline.” If you realize your conversion rate is decreasing, maybe it’s time to start exploring other ways of scouting more qualified deals.

Win Rate

The final metric Keenan looks at embedding into a CRM project is win rate – in essence, comparing your success to the competitors’.1 When it comes to venture capitalism, all firms are unique and pursue different deals and ventures. Regardless, it’s important to keep track of the accomplishments of your own ventures’ milestones and also be aware of the competition. Tracking and reporting the success of each venture you fund can help you make better business decisions in the future.

The five vital metrics Keenan suggests implementing in your CRM project are crucial in driving success and help measure not only the interactions you have with your clients but also the productivity that occurs between you. Use them wisely, and you will more likely than not see improvements in your deal sourcing capabilities.